Why is it always us, the consumers/users, that are paying the price?

If we didn’t know before, then publicity tells us that our national electricity grid is presently under intense pressure. However, like many headline stories, they don’t really expose the major underlying issues at the centre of it all.

The way energy is market-traded in this country is pretty complicated. Maybe it is best described as a spider-web entanglement that’s hard to understand where it starts and where it ends.

But many are rightly asking, “Why is it always us, the consumers/users, that are paying the price?” Why do we have to wonder, ‘Is it safe to put food in the freezer?’, or ‘Will I be kept warm today/tonight?’

AGL is one of the big players in the energy market and has been in the headlines too. AGL is one of Australia’s oldest and largest integrated energy services providers, with a mighty share in both the electricity and gas markets.

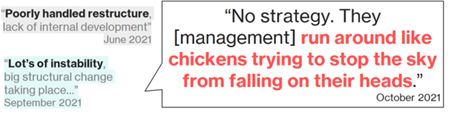

From the news, we know that the AGL’s Board had been caught in shareholder manoeuvrings around its plan for a demerger. This was ultimately rejected. Many investment houses and financial institutions, who are significant shareholders, were at pains to point out:

”“We believe AGL’s demerger plan is rooted in poor governance and misaligned interests, undermining both its credibility and motive.......AGL’s management have done little to address our concerns, pressing ahead with the demerger despite mounting criticism from other shareholders. In our view, this tunnel vision from management is emblematic of deeper governance problems at the heart of AGL”

Snowcap Investment ResearchResearcher and AGL shareholder

Software billionaire Mike Cannon-Brookes, who invested around $660 million into AGL in his bid to try and stop AGL, from splitting in two, has also gone on the record to say:

”“The de-merger makes no sense – not for the environment, not on economic grounds, not for the future of AGL’s employees, and not for its ability to obtain finance in a carbon conscious world. I do think there are shareholders who still care about both the E part (of ESG) and the S, in terms of social consequences, because the worker transition is going to be a horrible mess in the merged entity.”

Mike Cannon-Brookes, CEO of AtlassianOne of AGL's largest shareholders

Questions we need to ask

- What might any of these activities be telling us, especially about the organisation’s governance?

- One thing immediately might be, was it the Board’s actions or inactions that contributed to the issues mentioned above that AGL faced?

- Is this an example of a Board struggling to properly balance those competing interests in what it does or does not do as a company?

- Did the Board overlook the interests of their staff, the various communities in which it operates, the environmental factors, and its shareholder interests?

No one is suggesting that stakeholder interests always align or are easily reconciled. However, in today’s operating environment, Boards cannot afford to simply have as their primary focus taking action(s) that are primarily about shoring up or improving shareholder interests.

- Does this show a blind spot or lack of governance maturity from the AGL Board that the issue was allowed to get as far as it did?

- Who shoulders the responsibility for this – the Board or the Board and senior management team?

Being kind, it seems like the Board was caught off guard in reading the market. A market that is undergoing a massive renewable energy transition in a pace faster than they were willing to accept.

Image source: Snowcap’s Governance Issues Underpinning AGL’s Demerger

Caught off guard in reading the market

Just as mature human beings are expected to develop awareness and decision-making abilities, organisations are also expected to develop a state of self-awareness, assuming responsibility for their actions.

It is not new that environmental and social sustainability has become an important issue for shareholders and other stakeholders. Consumers and employees now seek to have a life that reflects a meaningful social impact, which means organisations and their Boards must adapt or face being called out.

It is not as if any of these issues were unknown, especially discussions around renewable energy and it being the way of the future. It is not as if we couldn’t see the increasing number of rooftop and large solar, as well as wind turbines, being installed around Australia, making coal plants less profitable. More and more renewables are churning out increasing amounts of power into the grid.

Surely, it is a reasonable assumption that as a significant polluter AGL has given full and proper consideration to the issue?

It is now inappropriate to adopt a singular stance around creating shareholder value, rather it is more one of seeking to accommodate stakeholder value.

For the future it is imperative that organisations seek to pursue a broader range of interests and to take a longer-term position when balancing these interests as part of planning.

In addition, these broad interests are wanting meaningful and workable ongoing relationships. One aspect of this entails better stakeholder communications which is expected to include a high level of transparency and in turn accountability.

While there are many programs out there including ESG, too often they can be used as another compliance-based type program, or a marketing exercise, or more meeting a formulaic arrangement to tick an internal box. What this tells us is there is a lack of perspective and substance. There is also often a failure to pursue these aspects through a thorough integration of the different elements as part of the organisation’s core strategy.

Of course, having it as part of your strategy is not a guarantee for success. If any of the set targets are inexact or diffuse in meaning, then we are reminded of Alice’s challenge and Humpty Dumpty’s response:

”’The question is,’ said Alice, ‘whether you can make words mean so many different things.’

’The question is,’ said Humpty Dumpty, ‘which is to be master — that’s all.”

Lewis CarrollThrough the Looking Glass

Do you want a sustainable operation?

The essential fundamental questions for the Board and senior executives are:

“Do we want to be a sustainable operation? And if a resounding yes, then are we fully committed to doing things differently?”

If you are moved to saying yes, then Enterprise Care can facilitate you to focus on what matters most, identifying what to capture in your strategy and actions, and finally what are the ongoing measures to ensure success in embedding and achieving your performance.

Contact us today to arrange a consultation and receive a personalised proposal.